FindItMore | Gaining a significant foothold in the existing competition is what every aspiring business owner wants. But what if attaining that goal could be hindered because of a long list of debts from evasive customers? According to an article in thebalance.com, consumer debts in the United States have increased to over 5% which is equivalent to a whopping $4.09 trillion. Bad debts can make any small business suffer in the long run. Thankfully, there are several firms today that can provide help when it comes to getting rid of any customer’s delinquent accounts. This firms is known as a debt collector.

A debt collector is a firm or company that specializes in offering services such as collecting unpaid debts in place of their clients. Most businesses nowadays face the problem of losing a considerable amount of profit due to a plethora of delinquent accounts from elusive customers. Attempting to collect these undue bills themselves is an absolute waste of their valuable resources and time; hence; they found that hiring a debt collecting agency is a more economical way to prevent constant loss in sales. Another benefit of hiring debt collectors is that they possess the most efficient resources in tracking down the most elusive debtors.

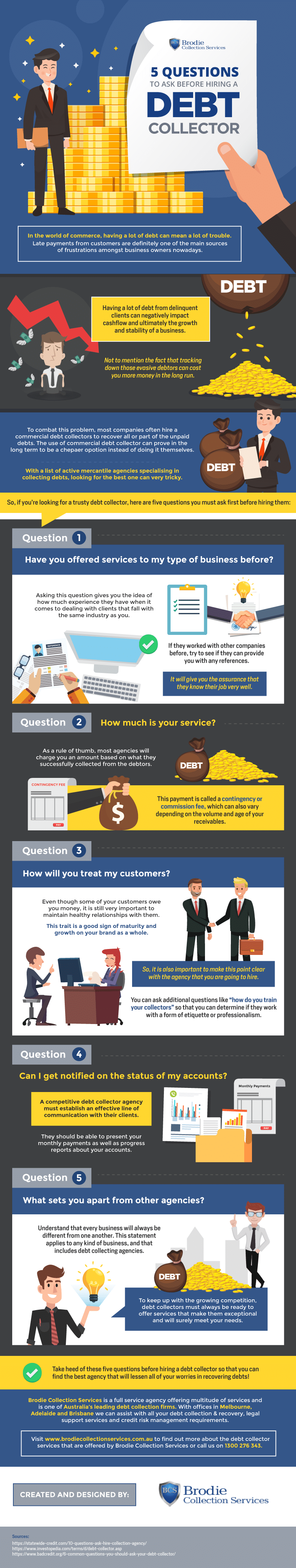

If you’re a business owner facing the same dilemma right now, then choosing the best debt collecting agency is the first step that you need to make. There’s a great number of collecting agencies that you can choose from, but before hiring one, you should be aware of certain information about them that can assure you on the quality of service they provide:

- Their former clients – Determining whether they have already offered services to clients identical to your line of products and services can give you an idea on their experience and skills in potentially dealing with your customers in the future.

- The rate of their service – Debt collecting agencies usually charge an amount based on what they successfully retrieved. This is called a contingency or commission fee.

- The way they will treat your customers – Maintaining rapport with your customers is still paramount to your success, so you need to know what kind of treatment they should receive on a debt collecting agency.

- How they will notify you about the status of your accounts – Your debt collecting agency is your business partner, so establishing an effective line of information is highly important.

- What sets them apart from other agencies – No business is exactly the same. But knowing whether they can offer something exclusive or better is one of the signs that you should hire that debt collecting agency right away.

The infographic below by Brodie Collection Services gives you five of the questions that you should ask debt collecting agency: